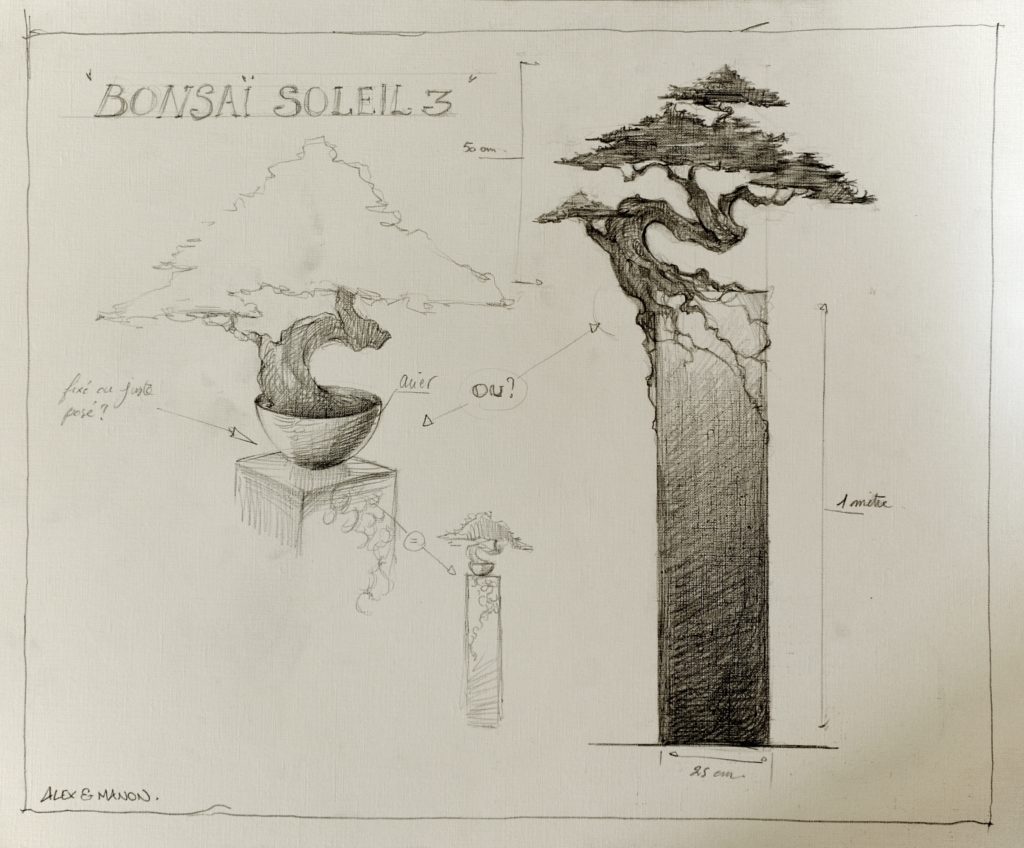

Comissionned works

We offer support in the development of a project, in listening to desires and ideas, we can, in collaboration with you, imagine, sketch and submit to you a monumental sculpture or an interior work.

We can adapt to the context and adjust our know-how to a specific request, offer different patinas and treatments.

Taxation

TAXATION OF WORKS OF ARTS ACQUIRED BY FRENCH COMPANIES

Whether it is an SA, a SARL, or a EURL (liberal profession), it is possible to acquire works of art whose price can be fully deducted from the amount of tax , under certain conditions, including the obligation to exhibit the work in a place accessible to the public (waiting room, entrance hall, meeting room).

Companies which buy, from January 1, 2002, original works of living artists and register them in a fixed asset account can deduct from the result of the acquisition year and the four following years, in equal fractions, a sum equal to the purchase price. The deduction thus made for each financial year may not exceed the limit mentioned in the first paragraph of 1 of Article 238 bis, reduced by the total of the payments mentioned in the same article. To benefit from the deduction provided for in the first paragraph, the company must exhibit in a place accessible to the public the property it has acquired for the period corresponding to the acquisition exercise and the following four years. The sums are now deductible within the limit of 5% of turnover, less payments made in application of article 238 bis.

Code Général des Impôts Article 238 bis AB

Complete documentations :

BULLETIN OFFICIEL DES IMPÔTS DIRECTION GÉNÉRALE DES IMPÔTS 4 C-5-04 N° 112 du 13 JUILLET 2004

Chapitre 2, section 1 et 2, articles 100 et suivants

Comments are closed.