Travaux de commande

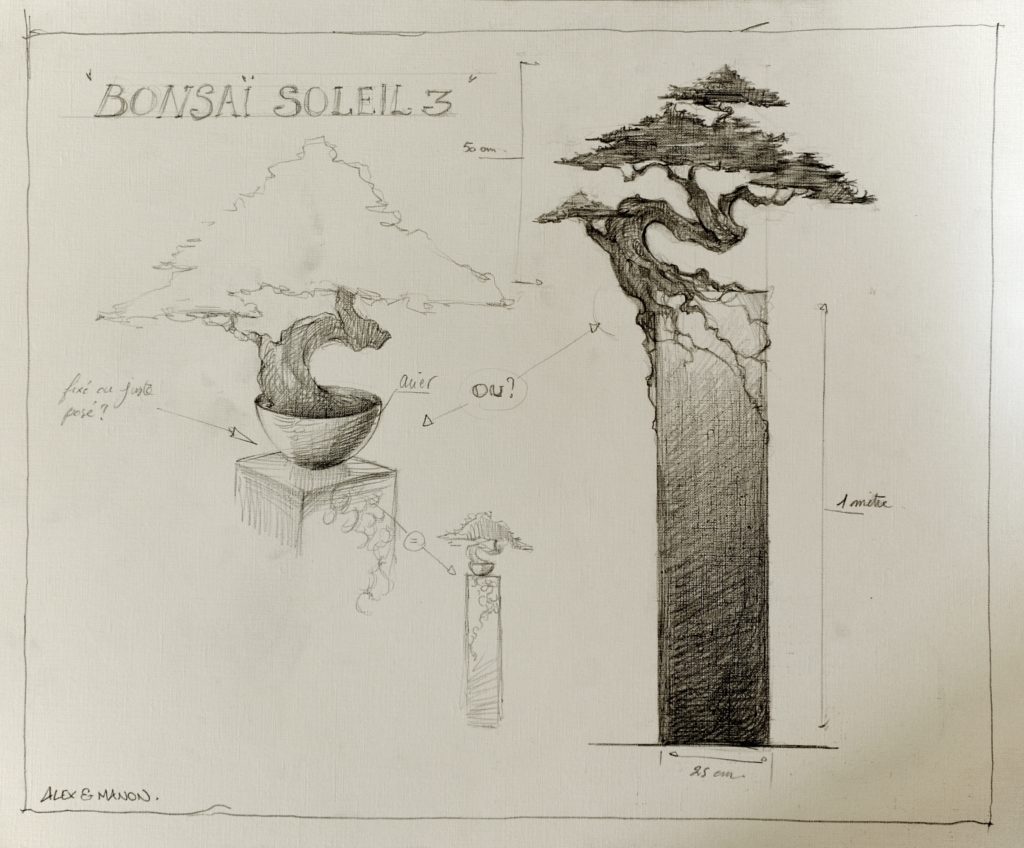

Nous proposons un accompagnement dans l’élaboration de projet, dans l’écoute des envies et des idées, nous pouvons, en collaboration avec vous, imaginer, croquer et vous soumettre une sculpture monumentale ou une oeuvre d’intérieur.

Nous pouvons nous adapter au contexte et ajuster notre savoir faire à une demande spécifique, proposer différentes patines et traitements.

Fiscalité

DÉFISCALISATION DES ŒUVRES D’ARTS ACQUISES PAR DES ENTREPRISES FRANÇAISES

Qu’il s’agisse d’une SA, d’une SARL, ou d’une EURL (profession libérale), il est possible d’acquérir des œuvres d’arts dont le prix peux être entièrement déduit du montant de l’impôt, sous certaines conditions, dont l’obligation d’exposer l’œuvre dans un lieu accessible au public (salle d’attente, hall d’entrée, salle de réunion).

Les entreprises qui achètent, à compter du 1er janvier 2002, des œuvres originales d’artistes vivants et les inscrivent à un compte d’actif immobilisé peuvent déduire du résultat de l’exercice d’acquisition et des quatre années suivantes, par fractions égales, une somme égale au prix d’acquisition. La déduction ainsi effectuée au titre de chaque exercice ne peut excéder la limite mentionnée au premier alinéa du 1 de l’article 238 bis, minorée du total des versements mentionnés au même article. Pour bénéficier de la déduction prévue au premier alinéa, l’entreprise doit exposer dans un lieu accessible au public le bien qu’elle a acquis pour la période correspondant à l’exercice d’acquisition et aux quatre années suivantes. Les sommes sont désormais déductibles dans la limite de 5 % du chiffre d’affaires, diminuée des versements effectués en application de l’article 238 bis.

Code Général des Impôts Article 238 bis AB

Documentations complète :

BULLETIN OFFICIEL DES IMPÔTS DIRECTION GÉNÉRALE DES IMPÔTS 4 C-5-04 N° 112 du 13 JUILLET 2004

Chapitre 2, section 1 et 2, articles 100 et suivants

Comments are closed.